President Donald Trump doubled tariffs on Turkish metals exports to the United States last week prompting Turkey, which says it will not bow to threats, to raise tariffs on US cars, alcohol and tobacco by the same amount on Wednesday.

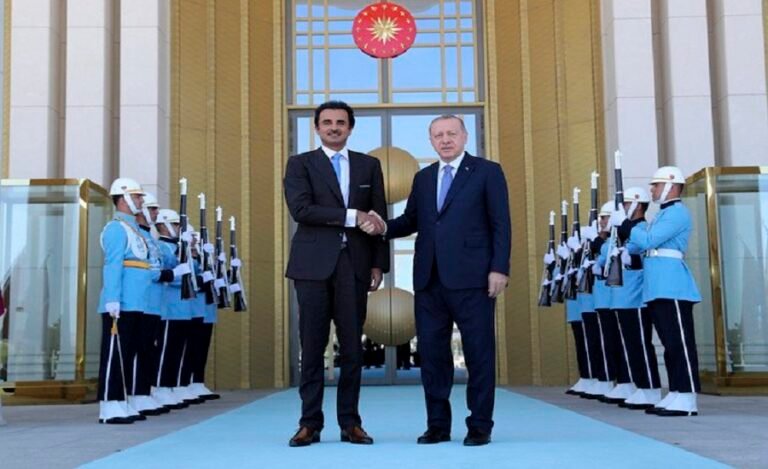

ANKARA (Reuters) — Qatar pledged $15 billion of investment into the Turkish economy on Wednesday, offering further support to a lira rally after the central bank tightened liquidity and curbed selling of the currency. Qatar’s Emir approved the package of economic projects, investments and deposits after a meeting in Ankara with President Tayyip Erdogan.

His government is grappling with a currency crisis and a damaging dispute with the United States that late on Wednesday appeared further than ever from being resolved.

The Qatari money will be channelled into banks and financial markets, a Turkish government source told Reuters. The lira has lost nearly 40 per cent against the dollar this year, driven by worries over Erdogan’s growing control over the economy and his repeated calls for lower interest rates despite high inflation.

The dispute with NATO partner the United States, focused on a tit-for-tat tariff row and the detention in Turkey of a US pastor, helped turn the currency’s steady decline into meltdown. It touched a record low of 7.24 to the dollar early on Monday, rattling global stock markets and threatening the stability of Turkey’s financial sector.

President Donald Trump doubled tariffs on Turkish metals exports to the United States last week prompting Turkey, which says it will not bow to threats, to raise tariffs on US cars, alcohol and tobacco by the same amount on Wednesday. The White House called the Turkish response a step in the wrong direction.

Despite the political tensions, the lira rebounded some 6 per cent on Wednesday, strengthening to around 6.0 to the dollar. There was also optimism about better relations with the European Union after a Turkish court released two Greek soldiers pending trial. Turkey’s Foreign Minister Mevlut Cavusoglu said ties with the bloc, which have been strained in recent years, were on a firmer basis and had started normalising.

A banking watchdog’s step to limit foreign exchange swap transactions also helped the currency. “They are squeezing lira liquidity out of the system now and pushing interest rates higher,” said Cristian Maggio, head of emerging markets strategy at TD Securities. “Rates have gone up by 10 per cent … The central bank has

not done this through a change in the benchmark rates, but they

are squeezing liquidity, so the result is the same,” Maggio said.

The lira firmed as far as 5.75 against the dollar on Wednesday and stood at 6.030 at 1758 GMT. “Remarkable turnaround,” Tim Ash, Bluebay Asset Management senior emerging markets analyst wrote in a client note after the banking watchdog BDDK cut the limit for Turkish banks’ forex swap, spot and forward transactions with foreign banks to 25 per cent of equity. “They are killing offshore lira liquidity to stop foreigners shorting the lira,” he said.

Turkey’s Capital Markets Board (SPK) later said it reduced leverage ratios until September 3 on new positions in foreign exchange markets to avoid fluctuations. The finance minister will seek to reassure international investors on Thursday in a conference call for which a ministry official said some far 3,000 people had signed up.

The chief executive of Turkey’s Akbank said the banking sector remained strong and the measures taken to support the market had started to have an impact, adding there was no withdrawal of deposits.

Spat with US

A decree signed by Erdogan doubled Turkish tariffs on US imports of passenger cars to 120 per cent, alcoholic drinks to 140 per cent and leaf tobacco to 60 per cent. Tariffs were also doubled on goods such as cosmetics, rice and coal. The duties were raised in response to the US administration’s “deliberate attacks on our economy,” Vice President Fuat Oktay said.

The United States was the fourth largest source of imports to Turkey last year, accounting for $12 billion, according to IMF statistics. Turkey’s exports to the United States, its fifth-largest export market, were $8.7 billion. The two countries have been at loggerheads over diverging interests in Syria, Ankara’s ambition to buy Russian defence systems and Andrew Brunson, a pastor on trial in Turkey on terrorism charges.

Trump has repeatedly asked for Brunson’s release. On Wednesday, a court in Izmir, where Brunson is on trial, rejected his appeal to be released from house arrest. An upper court had yet to rule on the appeal, his lawyer told Reuters.

Erdogan has said Turkey is the target of an economic war, and made repeated calls for Turks to sell their dollars and euros. On Tuesday, he said Turkey would boycott US electronic products. In another high-profile case, a Turkish court freed Taner Kilic, the local chair of Amnesty International, a researcher from the rights group said.