Jason Lange and Lisa Lambert

WASHINGTON Reuters): The top Federal Reserve official charged with bank regulation said on Friday that he would resign, giving President Donald Trump the ability to reshape the powerful board governing the U.S. financial system just as he begins revamping and undoing reforms put in place after the 2007-09 financial crisis.

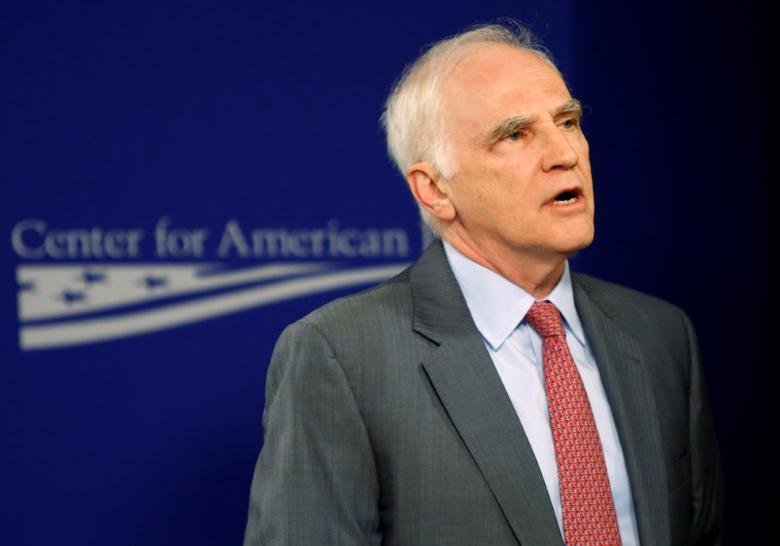

Daniel Tarullo, at the Fed since 2009, said in his brief resignation letter to Trump that he would leave the central bank “on or around April 5.”

Much of Tarullo’s legacy involves erecting safeguards after the crisis and accompanying recession, where big banks crumbled or were driven by the Fed and U.S. Treasury into shotgun mergers intended to make them stronger. With the goal of never needing taxpayer bailouts of failed banks, Tarullo has been strict about carrying out the 2010 Dodd-Frank Wall Street reform law. He has also pushed for bigger capital buffers and other checks on potential risks the largest banks may pose to the world’s financial system.

His departure leaves broad questions about the future of financial regulation, especially as Trump has ordered a review of what his administration considers onerous bank rules.

Many had expected Tarullo to step down but “the timing is earlier than anticipated, said Mohamed El-Erian, chief economic adviser at Allianz, adding that it would give the Trump administration “greater scope to shape the Board.”

Bank stocks moved higher in the moments following the announcement, with the S&P banks industry group index rising by 0.35 percent.

Trump now will have three positions to fill on the Fed’s Board of Governors, which at full strength has seven members. He will also have the opportunity to nominate a replacement for Fed chief Janet Yellen when her four-year term as chair ends in January 2018. Fed Vice Chairman Stanley Fischer also completes his term in 2018.

“The new administration will have an opportunity to recraft the Board in a remarkably short period of time,” said Stephen Stanley, an economist at Amherst Pierpont Securities.

The administration has already said it would appoint a new Fed governor charged with heading financial regulation, a post created in Dodd-Frank. Tarullo was never formally confirmed for it, but stepped into the role.

David Nason, a former deputy to Treasury Secretary Henry Paulson in 2008 and General Electric executive, is the front runner for the post, according to sources familiar with the matter. John Allison, a former BB&T CEO who has said he would like to abolish the Fed, has also been mentioned as a potential nominee.

In recent months, Tarullo sharply questioned moves by Republican lawmakers to roll back post-crisis regulations, putting him at odds with House Financial Services Committee Chairman Jeb Hensarling. Last year he criticized Hensarling’s bill that would give banks the choice to comply with Dodd-Frank or hold higher amounts of capital, saying the proposed capital ratio was too low. Hensarling is expected to bring up the plan again in a new bill soon.

Besides crafting regulation, Tarullo is a voter on interest rate policy and his record shows he has tended toward caution on raising interest rates.

The Fed signaled in December it could raise interest rates three times this year.

(Additional reporting by Jonathan Spicer and Jennifer Ablan in New York and Ann Saphir in San Francisco; Writing by David Chance and Lisa Lambert; Editing by Clive McKeef and Andrea Ricci)